Oncotelic Therapeutics, OTLC, is a unique Immuno-Oncology company at the cutting edge of medical research and discovery of precision medicine – Oncotelic is creating new pathways by combining AI tools to accelerate discovery by a magnitude, the AI (in the cloud) helps their team of scientists select the best and most effective molecules, eliminate subpar molecules from the earliest stage of discovery, thereby, saving precious time and increasing the chances of breakthrough discoveries, eliminating the probability of errors and omission by a significant margin, and by merging the AI tools with proven expertise in medicine, the Oncotelic team has cut the time and reduced R&D budget leakage and waste by a huge margin, at Oncotelic every R&D dollar is optimized to deliver better ROI and highly effective drugs/therapies in the most efficient manner than ever before.

Oncotelic is led by one of the most renowned scientists in America, a pioneer in immuno-oncology, a man with 39 Patents to his name and over 100 Patent Applications Pending – Dr. Vuong Trieu.

Dr. Vuong was a joint patent holder who helped develop the block-buster billion dollar drug Abraxane™ – now owned by Bristol-Myers Squibb, NYSE: BMY, a $144 billion dollar company.

Dr. Vuong has put together a team of highly distinguished scientists and researchers, and a superb management team with years of proven marketing, brand building and scaling experience – a team that has turned startups into multi-billion dollar enterprises.

Oncotelic Developing Distinct Drugs Targeting Several Extremely Brutal Diseases (Each of them has the potential to be a block buster) let’s focus on one for now.

Primary Focus:

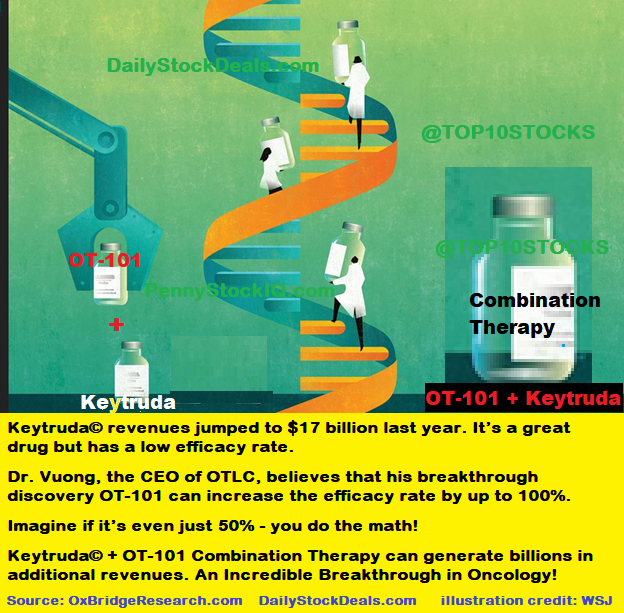

The one we are most excited about for the time being (without diminishing the importance of the other drugs that are in various stages of development) is a potential therapy that could increase the efficacy of an existing FDA approved drug (by as much as 100%) a drug that has generated over $17 billion in revenue last year alone and expected to hit $20 billion in 2025. The name of the drug is Keytruda owned by Merck.

Keytruda meet > OT-101

What Dr. Vuong and his excellent team did here is absolutely breathtaking! Dr. Vuong likes Keytruda, it’s great and it’s helping a lot of folks but it could do more, a whole lot more! When you combine the existing drug (Keytruda) with Dr. Vuong’s breakthrough discovery (after the FDA approval) the initial indications are that the rate of efficacy of Keytruda can increase by up to 100%!

Dr. Vuong’s newly discovered – inhibitor blocker eliminator – when given to patients along with Keytruda, the patients who are currently not benefiting can benefit! Imagine the relief combo-therapy can bring to the patients and their families around the world, right now, a lot of patients who can not benefit from Keytruda alone – can soon benefit from the combination therapy which Dr. Vuong has discovered!

Dr. Voung’s discovery is one of the most brilliant things I’ve ever seen – let me recap – A highly successful FDA approved Block Buster Drug that’s on the market today, whose efficacy can jump as much as 100% from where it is now – That’s what motivates me and the team at Oncotelic, a lot of patients and their families are needlessly suffering now!

As an investor you obviously look at the size of addressable market and that’s what motivates investors, right? As I’ve mentioned Keytruda has made $17 billion for Merck last year – if Dr. Vuong’s invention/discovery helps increase the efficacy rate of Keytruda even by only 50%, you do the math! We are talking about an opportunity worth billions! Think about it.

OT-101 Pipeline

Oncotelic is an artificial intelligence driven immuno-oncology company with a robust pipeline of first in class TGF-β immunotherapies for late stage cancers such as gliomas, pancreatic cancer and melanoma. OT-101, the lead immuno-oncology drug candidate of Oncotelic, is a first-in-class anti-TGF-β RNA therapeutic that exhibited single agent activity in relapsed/refractory cancer patients.

Rare Pediatric Cancer Designation

Oncotelic is seeking to leverage its deep expertise in oncology drug development to improve treatment outcomes and survival of cancer patients with a special emphasis on rare pediatric cancers. Oncotelic also has rare pediatric designation for DIPG (OT-101), melanoma (CA4P), and AML (OXi 4503). The Company also acquired (“PointR”) Data in November 2019.

Management Team

Dr. Voung Trieu, PHD, CEO, Chairman

Dr. Trieu, an expert in pharmaceutical development, currently serves as CEO/Chairman of Oncotelic Inc. Previously he was President and CEO of Igdrasol- developer of 2nd generation Abraxane- where he pioneer the regulatory pathway for approval of paclitaxel nanomedicine through a single bioequivalence trial against Abraxane. When Igdrasol merged with Sorrento Therapeutics, he became CSO and Board Director. He was Board Director of Cenomed- a company focusing on CNS drug development. Before that he was Director of Pharmacology, Pharmacokinetics, and Biology at Abraxis where he lead the development of albumin encapsulated therapeutics along building high throughput platform for small molecules, mirRNA, kinases. Prior to that he was Group Leader at Applied Molecular Evoluton where he was developing biobetter for Humira and Enbrel. Before that he was Director of Cardiovascular Biology at Parker Hughes Institute. Dr. Trieu holds a PhD in Microbiology, BS in Microbiology and Botany. He is member of ENDO, ASCO, AACR, and many other professional organization. Dr. Trieu published widely in oncology, cardiovascular, and drug development. Dr. Trieu has over 100 patent applications and 39 issued US patents.

Seymour Fein, MD, CMO

Dr. Fein’s professional activities have been focused on drug development research for over 35 years. He has been extensively involved in the successful evelopment of numerous drugs, biologics and medical devices over this time leading to FDA approvals for over 20 drugs (NDAs, sNDAs, BLAs) and devices (PMAs). Dr. Fein began his career at Hoffmann-La Roche Ltd. as a senior research physician and was responsible for a clinical development program that led to U.S. Food and Drug Administration (FDA) approval of recombinant interferon-alpha for cancer treatment. Dr. Fein was also the medical director of Bayer Healthcare Pharmaceuticals (U.S.) where he was responsible for therapeutic areas including gastroenterology, oncology, and cardiology. He later served as medical director for Rorer Group (now part of Sanofi) and Ohmeda (now part of Baxter). Dr. Fein founded and has been managing partner of a clinical and regulatory consulting organization and has worked closely with the Division of Gastroenterology and Inborn Errors Products at the FDA. He has participated in the development of and FDA approval of numerous drug products in many therapeutic areas. Dr. Fein has successfully overseen entrepreneurial drug development leading to the FDA approval of two orphan drug products in the field of gastroenterology.

Dr. Fein received his B.A. degree from the University of Pennsylvania and his M.D. degree with honors from New York Medical College. He completed a three-year residency in internal medicine at Dartmouth and a three-year fellowship in medical oncology and hematology at Harvard Medical School, where he served as an instructor of medicine during his final fellowship year. Dr. Fein is board-certified in both oncology and internal medicine.

Amit Shah, CFO

Amit Shah, age 53, has served as a senior financial officer for a number of life science companies, including Chief Financial Officer at Marina Biotech, Inc., a publicly traded biotechnology company (2017 to 2018); Vice President of Finance & Accounting and Acting Chief Financial Officer at Insightra Medical Inc. (2014 to 2015); VP Finance and Acting Chief Financial Officer at IgDraSol Inc. (2013); Corporate Controller & Director of Finance at ISTA Pharmaceuticals (2010 to 2012); Corporate Controller at Spectrum Pharmaceuticals (2007 to 2010): and as Controller / Senior Manager Internal Audits at Caraco Pharmaceuticals Laboratories (2000 to 2007). In addition to his work with life sciences companies, Mr. Shah served as the Chief Financial Officer at Eagle Business Performance Services, a management consulting and business advisory firm (2018 through March 2019) and as a consultant and ultimately Senior Director of Finance – ERP, at Young’s Market Company (2015 to 2017). Mr. Shah received a Bachelor’s of Commerce degree from the University of Mumbai, and is an Associate Chartered Accountant from The Institute of Chartered Accountants of India. Mr. Shah is also an inactive CPA from Colorado, USA

Saran Saund, CBO/GM of AI Division

Silicon Valley entrepreneur, Saran has been founder, CEO and GM at startups and public companies. Passionate about applying technology innovations to real world markets, he successfully founded an AI consortium to accelerate enterprise adoption of AI which engaged leading universities and technology vendors. A startup veteran, his track record includes senior leadership roles at companies that were acquired by leaders such as Marvell (MRVL) and Qualcomm (QCOM). His startup Cybercash (CYCH) had a successful IPO on NASDAQ. Saran started his career at Xerox PARC pushing 1’s and 0’s as a software engineer

Anthony E. Maida III, PhD, Chief Clinical Officer-Translational Medicine

Dr. Maida, an expert in immuno-oncology, currently serves as Senior Vice President – Clinical Research at Northwest Biotherapeutics, Inc. Prior to joining Northwest Dr. Maida served as Vice President, Clinical Research and General Manager, Oncology, World-wide at PharmaNet, Inc. Prior to joining PharmaNet Dr. Maida served as Chairman, Founder and Director of BioConsul Drug Development Corporation and Principal of Anthony Maida Consulting International, servicing pharmaceutical firms, venture capital, hedge funds and Wall Street. Dr. Maida’s skill set includes the leading execution and oversight of finance, operations, research, clinical and scientific development, regulatory and manufacturing for the development of various oncology immunotherapies. Over the past 25 years Dr. Maida has served in a number of executive roles, including, Chairman, CEO, COO, CSO, CFO and business development. Over recent years Dr. Maida has raised, or assisted in financings, nearly $200 million for emerging biotechnology companies. Dr. Maida serves as an advisor, consultant and technical analyst for CMX Capital, LLC, Sagamore Bioventures, Roaring Fork Capital, Toucan Capital, North Sound Capital, The Bonnie J. Addario Lung Cancer Foundation and vFinance; the later three companies are located on the East Coast. Additionally, Dr. Maida has been retained by Abraxis BioScience, Inc., Northwest BioTherapeutics, Inc. and Takeda Chemical Industries, Ltd. (Osaka, Japan). Dr. Maida holds a Ph.D. in Immunology, a B.A. degree in Biology, a B.A. Degree in History, a MBA and a MA in toxicology. He is a member of the American Society of Clinical Oncology (ASCO), the American Association for Cancer Research

About Daily Stock Deals / OTC KING

Daily Stock Deals helps emerging growth companies reach individual and institutional investors. Daily Stock Deals and its affiliates publish research reports, market analysis and daily stock picks to help investors make informed decisions and achieve their individual investment goals. Our Platform is supported by companies we profile on our network, therefore, our views are neither free of conflict, nor intended as advise to buy/sell any securities and we strongly urge you to read our TOS, Disclaimer/Disclosure and consult with qualified experts. If you would like to get your company featured on Daily Stock Deals network or have any questions, please feel free to contact the editor. editor@DailyStockDeals.com thanks!

Daily Stock Deals is an affiliated/partner property, please read TOS/Disclaimer/Disclosure, thanks!

Daily Stock Deals

Daily Stock Deals