OTLC, Oncotelic, AI Powered Immunology

Oncotelic Therapeutics, OTLC, is a unique Immuno-Oncology company at the cutting edge of medical research and discovery of precision medicine – Oncotelic is creating new pathways by combining AI tools to accelerate discovery by a magnitude, the AI (in the cloud) helps their team of scientists select the best and most effective molecules, eliminate subpar molecules from the earliest stage of discovery, thereby, saving precious time and increasing the chances of breakthrough discoveries, eliminating the probability of errors and omission by a significant margin, and by merging the AI tools with proven expertise in medicine, the Oncotelic team has cut the time and reduced R&D budget leakage and waste by a huge margin, at Oncotelic every R&D dollar is optimized to deliver better ROI and highly effective drugs/therapies in the most efficient manner than ever before.

Oncotelic is led by one of the most renowned scientists in America, a pioneer in immuno-oncology, a man with 39 Patents to his name and over 100 Patent Applications Pending – Dr. Vuong Trieu.

Dr. Vuong was a joint patent holder who helped develop the block-buster billion dollar drug Abraxane™ – now owned by Bristol-Myers Squibb, NYSE: BMY, a $144 billion dollar company.

Dr. Vuong has put together a team of highly distinguished scientists and researchers, and a superb management team with years of proven marketing, brand building and scaling experience – a team that has turned startups into multi-billion dollar enterprises.

Oncotelic Developing Distinct Drugs Targeting Several Extremely Brutal Diseases (Each of them has the potential to be a block buster) let’s focus on one for now.

Primary Focus:

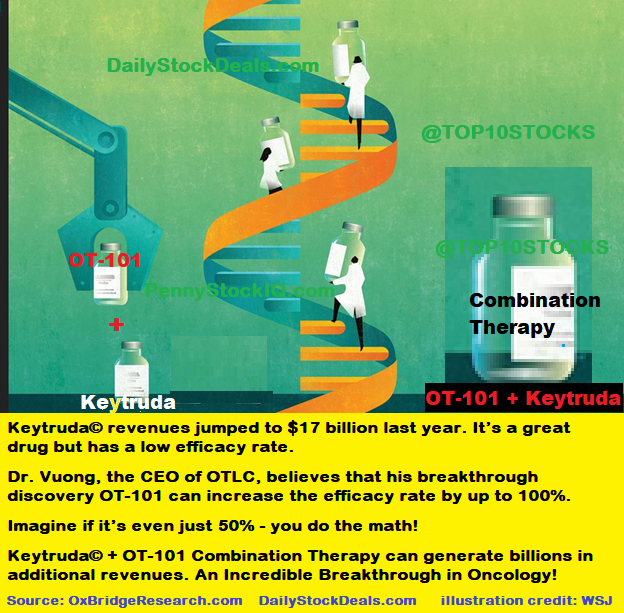

The one we are most excited about for the time being (without diminishing the importance of the other drugs that are in various stages of development) is a potential therapy that could increase the efficacy of an existing FDA approved drug (by as much as 100%) a drug that has generated over $17 billion in revenue last year alone and expected to hit $20 billion in 2025. The name of the drug is Keytruda owned by Merck.

Keytruda meet > OT-101

What Dr. Vuong and his excellent team did here is absolutely breathtaking! Dr. Vuong likes Keytruda, it’s great and it’s helping a lot of folks but it could do more, a whole lot more! When you combine the existing drug (Keytruda) with Dr. Vuong’s breakthrough discovery (after the FDA approval) the initial indications are that the rate of efficacy of Keytruda can increase by up to 100%!

Dr. Vuong’s newly discovered – inhibitor blocker eliminator – when given to patients along with Keytruda, the patients who are currently not benefiting can benefit! Imagine the relief combo-therapy can bring to the patients and their families around the world, right now, a lot of patients who can not benefit from Keytruda alone – can soon benefit from the combination therapy which Dr. Vuong has discovered!

Dr. Voung’s discovery is one of the most brilliant things I’ve ever seen – let me recap – A highly successful FDA approved Block Buster Drug that’s on the market today, whose efficacy can jump as much as 100% from where it is now – That’s what motivates me and the team at Oncotelic, a lot of patients and their families are needlessly suffering now!

As an investor you obviously look at the size of addressable market and that’s what motivates investors, right? As I’ve mentioned Keytruda has made $17 billion for Merck last year – if Dr. Vuong’s invention/discovery helps increase the efficacy rate of Keytruda even by only 50%, you do the math! We are talking about an opportunity worth billions! Think about it.

OT-101 Pipeline

Oncotelic is an artificial intelligence driven immuno-oncology company with a robust pipeline of first in class TGF-β immunotherapies for late stage cancers such as gliomas, pancreatic cancer and melanoma. OT-101, the lead immuno-oncology drug candidate of Oncotelic, is a first-in-class anti-TGF-β RNA therapeutic that exhibited single agent activity in relapsed/refractory cancer patients.

Rare Pediatric Cancer Designation

Oncotelic is seeking to leverage its deep expertise in oncology drug development to improve treatment outcomes and survival of cancer patients with a special emphasis on rare pediatric cancers. Oncotelic also has rare pediatric designation for DIPG (OT-101), melanoma (CA4P), and AML (OXi 4503). The Company also acquired (“PointR”) Data in November 2019.

Management Team

Dr. Voung Trieu, PHD, CEO, Chairman

Dr. Trieu, an expert in pharmaceutical development, currently serves as CEO/Chairman of Oncotelic Inc. Previously he was President and CEO of Igdrasol- developer of 2nd generation Abraxane- where he pioneer the regulatory pathway for approval of paclitaxel nanomedicine through a single bioequivalence trial against Abraxane. When Igdrasol merged with Sorrento Therapeutics, he became CSO and Board Director. He was Board Director of Cenomed- a company focusing on CNS drug development. Before that he was Director of Pharmacology, Pharmacokinetics, and Biology at Abraxis where he lead the development of albumin encapsulated therapeutics along building high throughput platform for small molecules, mirRNA, kinases. Prior to that he was Group Leader at Applied Molecular Evoluton where he was developing biobetter for Humira and Enbrel. Before that he was Director of Cardiovascular Biology at Parker Hughes Institute. Dr. Trieu holds a PhD in Microbiology, BS in Microbiology and Botany. He is member of ENDO, ASCO, AACR, and many other professional organization. Dr. Trieu published widely in oncology, cardiovascular, and drug development. Dr. Trieu has over 100 patent applications and 39 issued US patents.

Seymour Fein, MD, CMO

Dr. Fein’s professional activities have been focused on drug development research for over 35 years. He has been extensively involved in the successful evelopment of numerous drugs, biologics and medical devices over this time leading to FDA approvals for over 20 drugs (NDAs, sNDAs, BLAs) and devices (PMAs). Dr. Fein began his career at Hoffmann-La Roche Ltd. as a senior research physician and was responsible for a clinical development program that led to U.S. Food and Drug Administration (FDA) approval of recombinant interferon-alpha for cancer treatment. Dr. Fein was also the medical director of Bayer Healthcare Pharmaceuticals (U.S.) where he was responsible for therapeutic areas including gastroenterology, oncology, and cardiology. He later served as medical director for Rorer Group (now part of Sanofi) and Ohmeda (now part of Baxter). Dr. Fein founded and has been managing partner of a clinical and regulatory consulting organization and has worked closely with the Division of Gastroenterology and Inborn Errors Products at the FDA. He has participated in the development of and FDA approval of numerous drug products in many therapeutic areas. Dr. Fein has successfully overseen entrepreneurial drug development leading to the FDA approval of two orphan drug products in the field of gastroenterology.

Dr. Fein received his B.A. degree from the University of Pennsylvania and his M.D. degree with honors from New York Medical College. He completed a three-year residency in internal medicine at Dartmouth and a three-year fellowship in medical oncology and hematology at Harvard Medical School, where he served as an instructor of medicine during his final fellowship year. Dr. Fein is board-certified in both oncology and internal medicine.

Amit Shah, CFO

Amit Shah, age 53, has served as a senior financial officer for a number of life science companies, including Chief Financial Officer at Marina Biotech, Inc., a publicly traded biotechnology company (2017 to 2018); Vice President of Finance & Accounting and Acting Chief Financial Officer at Insightra Medical Inc. (2014 to 2015); VP Finance and Acting Chief Financial Officer at IgDraSol Inc. (2013); Corporate Controller & Director of Finance at ISTA Pharmaceuticals (2010 to 2012); Corporate Controller at Spectrum Pharmaceuticals (2007 to 2010): and as Controller / Senior Manager Internal Audits at Caraco Pharmaceuticals Laboratories (2000 to 2007). In addition to his work with life sciences companies, Mr. Shah served as the Chief Financial Officer at Eagle Business Performance Services, a management consulting and business advisory firm (2018 through March 2019) and as a consultant and ultimately Senior Director of Finance – ERP, at Young’s Market Company (2015 to 2017). Mr. Shah received a Bachelor’s of Commerce degree from the University of Mumbai, and is an Associate Chartered Accountant from The Institute of Chartered Accountants of India. Mr. Shah is also an inactive CPA from Colorado, USA

Saran Saund, CBO/GM of AI Division

Silicon Valley entrepreneur, Saran has been founder, CEO and GM at startups and public companies. Passionate about applying technology innovations to real world markets, he successfully founded an AI consortium to accelerate enterprise adoption of AI which engaged leading universities and technology vendors. A startup veteran, his track record includes senior leadership roles at companies that were acquired by leaders such as Marvell (MRVL) and Qualcomm (QCOM). His startup Cybercash (CYCH) had a successful IPO on NASDAQ. Saran started his career at Xerox PARC pushing 1’s and 0’s as a software engineer

Anthony E. Maida III, PhD, Chief Clinical Officer-Translational Medicine

Dr. Maida, an expert in immuno-oncology, currently serves as Senior Vice President – Clinical Research at Northwest Biotherapeutics, Inc. Prior to joining Northwest Dr. Maida served as Vice President, Clinical Research and General Manager, Oncology, World-wide at PharmaNet, Inc. Prior to joining PharmaNet Dr. Maida served as Chairman, Founder and Director of BioConsul Drug Development Corporation and Principal of Anthony Maida Consulting International, servicing pharmaceutical firms, venture capital, hedge funds and Wall Street. Dr. Maida’s skill set includes the leading execution and oversight of finance, operations, research, clinical and scientific development, regulatory and manufacturing for the development of various oncology immunotherapies. Over the past 25 years Dr. Maida has served in a number of executive roles, including, Chairman, CEO, COO, CSO, CFO and business development. Over recent years Dr. Maida has raised, or assisted in financings, nearly $200 million for emerging biotechnology companies. Dr. Maida serves as an advisor, consultant and technical analyst for CMX Capital, LLC, Sagamore Bioventures, Roaring Fork Capital, Toucan Capital, North Sound Capital, The Bonnie J. Addario Lung Cancer Foundation and vFinance; the later three companies are located on the East Coast. Additionally, Dr. Maida has been retained by Abraxis BioScience, Inc., Northwest BioTherapeutics, Inc. and Takeda Chemical Industries, Ltd. (Osaka, Japan). Dr. Maida holds a Ph.D. in Immunology, a B.A. degree in Biology, a B.A. Degree in History, a MBA and a MA in toxicology. He is a member of the American Society of Clinical Oncology (ASCO), the American Association for Cancer Research

About Daily Stock Deals /OTC King

Daily Stock Deals helps emerging growth companies reach individual and institutional investors. Daily Stock Deals and its affiliates publish research reports, market analysis and daily stock picks to help investors make informed decisions and achieve their individual investment goals. Our Platform is supported by companies we profile on our network, therefore, our views are neither free of conflict, nor intended as advise to buy/sell any securities and we strongly urge you to read our TOS, Disclaimer/Disclosure and consult with qualified experts. If you would like to get your company featured on Daily Stock Deals network or have any questions, please feel free to contact the editor. editor@DailyStockDeals.com thanks!

Daily Stock Deals is an affiliated/partner property, please read TOS/Disclaimer/Disclosure, thanks!

=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=

Omagine, Inc. (OTCQB: OMAG) Company Profile

Omagine is an entertainment, hospitality and tourism company with significant residential and commercial real estate development and property management activities.

The company is headquartered in New York City and has a subsidiary in Muscat, Oman. Omagine is focused on MENA Region real-estate development and hospitality opportunities because the company believes the enormous financial resources in the MENA region combined with a recent shift in economic development strategies of regional Governments present huge opportunities. (See how OMAG could benefit from it, click here)

The Vision

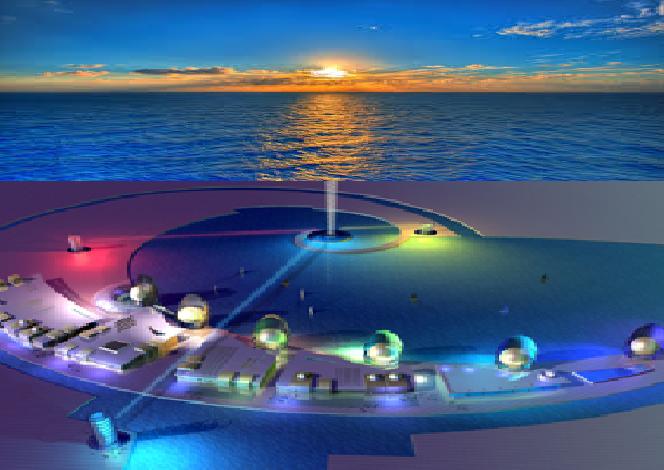

The company has signed a $2.5 billion development agreement with the Government of Oman, developing a mixed-use Tourism/Residential and Commercial/Retail project known as – The Omagine Project. The 245 acre prime beachfront property is located just 6 miles from Muscat International Airport. The beautiful Pearl shaped buildings will overlook the serene Gulf of Oman, surrounded by a vibrant art and culture scene, poised to inspire the world.

The Omagine Project is designed as an exquisite, modern architectural marvel built with environmentally friendly materials in a family friendly living/working space. It blends local values and customs for today’s global citizens where residents and visitors live, work and play in complete harmony with nature.

The existing majestic Sultan Qaboos Street, home to Muscat’s many landmarks, provides easy access to The Omagine Project, where art and culture thrive, residents and visitors experience Arabian hospitality, dine in fine restaurants and shop at exclusive showrooms of global brands. (See project overview, click here)

The Future

Most Americans are familiar with The Palm Islands of Dubai. The Palm started with a vision and a simple rendering, despite huge challenges, the vision came true. Dubai became one of the world’s top tourist destinations and one of most expensive real estate markets in the world.

THE PALM

THE PALM

The Omagine Project – and its Pearls – has the potential to become the next major tourism destination and one of the most highly desired real estate markets. Muscat could become the next hot destination for the tourists around the world.

The Omagine Project – The Pearls

The Omagine Project – The Pearls

Timing and Location is Everything!

The timing couldn’t be better for Chinese investors. The Stock Market in China down sharply and the Chinese economy slowing down considerably. Chinese investors looking for an alternative, discovered Dubai. Investors from China are flocking to Dubai. Huge demand from investors is driving up real estate prices in Dubai and the cost of living and doing business in Dubai has increased dramatically.

We believe, The Omagine Project (Muscat) offers the next great opportunity for investors and Global corporations doing business in the Middle East. Muscat’s low cost of living and cheaper office space offers a better ROI.

The Pearls (Muscat) expected to meet or exceed the lifestyle choice and luxury for less. It’s a great opportunity for Global corporations to establish their MENA headquarters in Muscat. Also, a unique opportunity for accredited investors seeking to diversify their portfolios.

Source: The Company, OxBridge Research, Daily Stock Deal, OTC King, OTC Stock Wire

Don’t miss the NEXT premium Alert! Sign-up, Get Alerts, MakeMoney!® Disclaimer/Disclosure: we received or expecting compensation from the featured company. Our firm, principals and staff may own/buy/sell/trade stock/securities of this company. Always Read the full Disclosure/Disclaimer. Thanks. If you want to learn more or get your company featured on Daily Stock Deal, please contact the Editor. editor [@] DailyStockDeals.com

================================================================

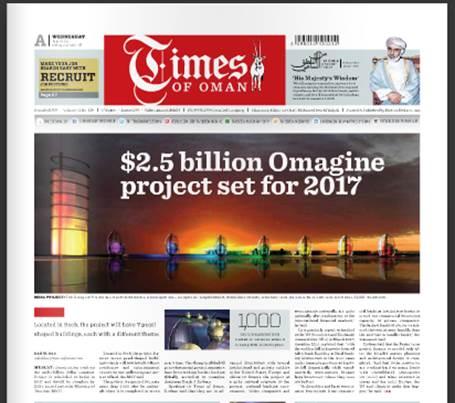

$2.5 billion Omagine pearl project set for 2017 in Oman

July 12, 2016

by Rahul Das/rahuldas@timesofoman.com

Muscat: Construction work on the multi-billion dollar Omagine Project is scheduled to begin in 2017 and should be complete by 2024, according to the Ministry of Tourism (MoT).

Located in Seeb, the project features seven pearl-shaped buildings which will host hotels, offices, residences and entertainment venues on one million square metres of land, the MoT said.

The project is expected to create more than 1,000 jobs for nationals when it is completed in seven year’s time. The slump in global oil prices has meant project managers have been seeking further funding globally, according to Omagine chairman Frank J. Drohan.

Speaking to Times of Oman, Drohan said that they are in advanced discussions with several institutional and private entities in the United States, Europe and China to finance the project as a quite rational response to the present regional banking environment. “Other companies and governments regionally are quite rationally also reaching out to the international financial markets,” he said.

Drohan said that the longer term project finance is needed only after the detailed master planning and architectural design is completed. “And that is the reason we are working hard on many fronts with Consolidated Contractors Co (CCC) and other investors in Oman and the GCC, Europe, the US and China to make that happen,” he said.

It was in October 2014, Omagine LLC, signed a development agreement with the Government of Oman for the development of a $2.5 billion real-estate and tourism project known as the Omagine Project.

In March 2015 the Ministry of Finance in Oman ratified the development agreement. In July 2015 the development rights to the 245 acres of beachfront land were registered with the government of Oman. In May, Omagine Inc. also sponsored The World Summit on Innovation & Entrepreneurship (WSIE) at the United Nations Headquarters in New York City.

The Omagine Project will have three hotels (which will include serviced apartments and chalets), a boutique mall, an open air amphitheatre, exhibition venues, a harbour and marina area, offices, more than 2,000 residences and a large number of cafes, restaurants and entertainment venues. The Omagine Project will have seven pearl shaped buildings, each with a different theme, such as the Oman Pearl, Innovation Pearl, Energy Pearl, Culture Pearl and Earth, Sea and Sky Pearls.

The Pearls will feature a wide range of tourism experiences, simulations, games, interactive demonstrations, multi-media presentations and a planetarium and a multiplex.

To learn more, please visit the company website: Omagine.com

Source: Times of Oman

================================================================

DSG Global, DSGT, Profile, Summary

DSG Global, Inc. (DSGT), a global leader in fleet management, providing comprehensive solutions for the Golf Industry, Commercial Fleets and critical applications for Military and other Government agencies.

The Company’s CEO has over 20 years of industry experience and, the executive team has over 50 years of combined experience, in designing and deploying Wireless networks and GPS tracking systems around the globe. (executive bios: management team, board of directors)

Proven Golf Course Management

DSG is unique in the industry, like Apple®, DSG is a hardware and a software company. Today over 15,000 vehicles on more than 300 Golf courses, around the world, run on DSG TAG system. (Testimonial From Happy Clients click here )

The United States alone has more than 15,000 Golf courses, the company has the potentially to capture thousands of Golf courses in the near future.

Comprehensive Commercial Fleet Management

From the Port of Long Beach, California to Portland, Maine, 15,000,000 (fifteen million) Trucks traverse America’s Highways, transporting goods worth trillions of dollars every day. Trucking industry in America is very diverse, thousands of owner/operators and companies with a fleet of thousands of trucks power American businesses. Most of these trucks are not equipped with advanced monitoring and routing systems.

DSG TAG System (DSGT) has the solution that could potentially save trucking industry billions of dollars, help increase safety and save precious lives on American Highways. DSGT has spent millions of dollars developing technology to improve safety and increase productivity. DSGT provides vertically integrated solution to help fleet owners better manage their assets and increase revenue. The software helps find safer and better routs, help increase on-time deliveries, keep customers happy and save fleet owners millions in maintenance and fuel cost. Savings & Benefits

Trucks Carry Goods worth Trillions of Dollars

Trucking industry is huge, there is no dominant player in GPS market, and the largest incumbent has under 40 thousand trucks under management. DSGT has technological and cost advantage over the competition that could help the company rapidly gain market share. DSGT is gearing up, adding more marketing staff to take advantage of multi-million dollar, recurring revenue, opportunity.

Partnered with Industry Leaders

Source: The Company, OxBridge Research, Daily Stock Deal, OTC King, OTC Stock Wire

Don’t miss the NEXT premium Alert! Sign-up, Get Alerts, MakeMoney!®

Disclaimer/Disclosure: we received or expecting compensation from the featured company. Our firm, principals and staff may own/buy/sell/trade stock/securities of this company. Always Read the full Disclosure/Disclaimer. Thanks. If you would like your company featured or want to learn more, please don’t hesitate to contact the Editor. editor [@] DailyStockDeals.com

================================================================

Teryl Resources | TRC.V/TRYLF | Profile

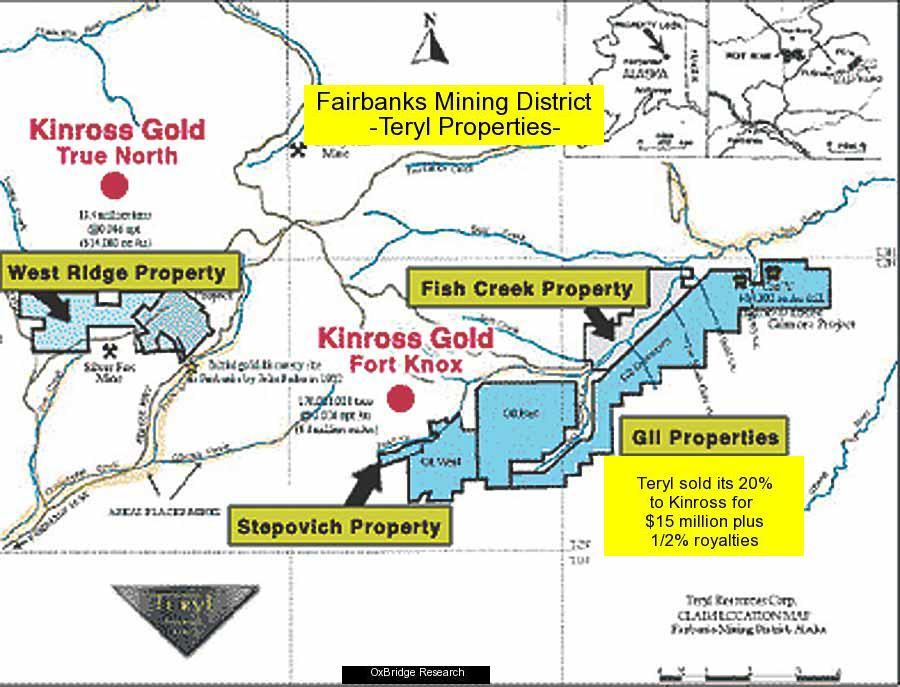

Teryl Resources Corp., – TRC.V / TRYLF – has several gold prospects near the Kinross Gold Corp’s Fort Knox Mine in Alaska, a silver/lead/zinc prospect adjacent to Silvercorp’s (SVM) mine in British Columbia, and Oil & Gas wells in Texas.

Teryl has a 10% net profit interest in the Stepovich claims. A 100% interest in the Westridge property and a 50% interest in the Fish Creek property, adjacent to the Gil property. Teryl sold its 20% interest in the Gil property in Fairbanks, Alaska, to Fairbanks Gold Mining Corp., a wholly owned subsidiary of Kinross Gold Corp. (KCG), for $15 million dollars plus a ½ of 1% royalty for the life of the mine.

Teryl owns a 30% working interest and a 10% NPI interest in the Silverknife property, a silver/lead/zinc prospect located in Northern B.C. adjacent to Silvercorp’s silver/lead/zinc discovery.

Teryl also has three producing oil and gas wells in Texas, these wells are operated by Anadarko Petroleum.

Fish Creek property

Teryl Resources has commenced a placer and hard rock diamond drilling program on the Fish Creek property in the Fairbanks, Alaska mining district.

Teryl’s consulting geologist, Paul D. Gray, P.Geo. will oversee the drilling program, core logging , and assay protocols on behalf of the Company. The operator of the drill will be Kenn Roberts of Texas, and Pete Rutledge, project manager.

Kenn Roberts, a First Nations from Yukon has multiple years of drilling experience in remote locations and has served as mineral development advisor to First Nations.

Teryl owns a 50% interest in the Fish Creek property, Keltic Bryce owns a 50% working interest and Linux Gold Corp. (LNXGF) retains a 5% royalty interest in Teryl’s interest.

The Fish Creek property consists of 30 claims adjacent to the Gil property, currently owned by Kinross Gold Corporation. The Gil 20% interest, previously owned by Teryl Resources Corp., was acquired by Kinross for $15 million dollars.

Westridge Property

A geological report on the Westridge gold property has been prepared by David Adams, B.S., M.S., CPG. Teryl has appointed Pete Rutledge, Geologist, as an independent contractor to evaluate the Westridge property.

The Westridge property is located approximately 16 km north of Fairbanks, Alaska. The property consists of 48 State of Alaska mining claims controlled by Teryl Resources Corp.

The claims cover approximately 1,749 acres on the north flank of the main ridge between Pedro Creek and upper Dome Creek; both of these drainages were significant historic placer gold producers. Access to the property is excellent: the Elliott Highway transects the westernmost edge of the property, and the Silver Fox Mine road transects the southwest portion of the property.

All claim holdings comprising the property are in good standing, and no encumbrances to future mining activities are known or anticipated.

SILVERKNIFE PROPERTY OWNERSHIP:

» Teryl Resources Corp. owns 30% working

interest and has a 10% Net Profit Interest

(“NPI”)

» Minewest Silver & Gold owns 70% subject to

the 10% NPI held by Teryl

The Silverknife Property

(Mineral Claims consisting of 1,594 Acres)

A proposed Phase I exploration program consisting of a desk study followed by a series of on-the-ground Property boundary and drill collar location surveys, followed by geophysics and diamond drilling with a recommended budget of $358,700 is recommended for the Silverknife Property.

The exploration programs (and budgets), presented herein, are designed to identify the accurate location of the mineral titles boundary with respect to historic drill collars and test the Silverknife Property’s precious and base metal mineral potential and will yield enough information to guide Minewest and Teryl subsequent mineral exploration programs on the Property. Samples have been collected to confirm the assay results, however, due to the inclement weather conditions, the Phase I exploration program has been delayed.

Sources: Teryl Resources Corp., Kinross Gold Corp., Linux Gold Corp., SilverCorp.

Forward-looking statements:- The Company’s actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements, including those described in the Company’s Financial Statements, Management Discussion and Analysis and Material Change Reports filed with the Canadian Securities Administrators and available at www.sedar.com, and the Company’s 20-F annual report filed with the United States Securities and Exchange Commission at www.sec.gov.

This profile/research report/email letter/blog/posting in forums/social-media/t/f does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities of the Company have not been registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Disclosure/Disclaimer:- OxBridge Research publishes sponsored research reports, advertorials and corporate profiles on its portal and several other websites/blogs, including this website/blog, owned and operated by OxBridge and/or its affiliates. OxBridge Research is not a Broker Dealer or a Registered Financial Adviser in any jurisdiction, whatsoever. All the information published on its website(s) and/or distributed to its members via various electronic means is for general awareness and entertainment purpose only. OxBridge urges investors to do their own due diligence and consult with their financial adviser prior to making any investment decision. We are expecting a payment of up to five thousand dollars in compensation from the company/a third party/shareholder. We receive compensation from companies for providing various IR services, including publication, advertisement,and social media awareness, therefore our views/opinion are inherently biased. Please read the full disclosure/disclaimer, if you need assistance contact Editor@OxBridgeResearch.com

OxbridgeResearch.com, All Rights Reserved. Trademarks/logos are of their respective owners.

It’s YOUR money – Invest WISELYTM

================================================================

Velti | VELT | Profile | Summary

Velti, VELT, is a mobile marketing provider founded over 13 years ago, it develops and executes highly interactive campaigns. Velti was among the first companies to initiate, develop, and deliver advertising and marketing initiatives across the mobile channel. Today Velti’s leading global marketing platform, connecting brands with consumers around the world.

The company delivers technology and services that enable companies to engage with and reach their consumers through innovative mobile marketing and advertising efforts. The mGage platform is available for agencies and companies ready for a set of self-service based tools that consolidate media management, simplify mobile asset production, and deliver highly engaging messaging campaigns. For those who want professional assistance in achieving mobile goals, Velti’s managed services organization offers expert help in developing strategies, programs, and hosting services to support mobile initiatives

The Velti team now has a global footprint in 15+ countries, supporting Fortune 500 companies around the world. Over the years, Velti has extended its global leadership position through the strategic acquisition of companies whose technologies offer synergies to the mGage platform. In 2010, Velti acquired Media Cannon, a developer of mobile advertising tools and technology, and Mobclix, a mobile ad exchange network. In 2011, Velti acquired Mobile Interactive Group (MIG), the UK’s largest mobile marketing company, and also Air2Web, a leading provider of mobile customer relationship management (mCRM) solutions for consumer brands in the United States and India. As of January 2012, Velti completed its acquisition of CASEE, the largest mobile advertising exchange in China.

The mGage®

Mobile Marketing Platform

Velti’s mGage empowers brands to use mobile to transform their business. Whether it’s ad delivery and measurement, cross-channel messaging campaigns, or mobile site development, our secure and scalable platform allows marketers to execute highly personalized, enterprise mobile marketing campaigns.

Velti makes it simple for you to capture the full revenue potential of your mobile ad inventory. A single SDK lets you work with as many ad networks as you like, giving you complete flexibility and control over the ads you run.

Sources: Velti , OxBridge Research, Daily Stock Deals, OTC King

Don’t miss the NEXT premium Alert! Sign-up, Get Alerts, MakeMoney!®

we received or expecting compensation from the featured company. Our firm, principals and staff may own/buy/sell/trade stock/securities of this company. Always Read the full Disclosure/Disclaimer. Thanks.